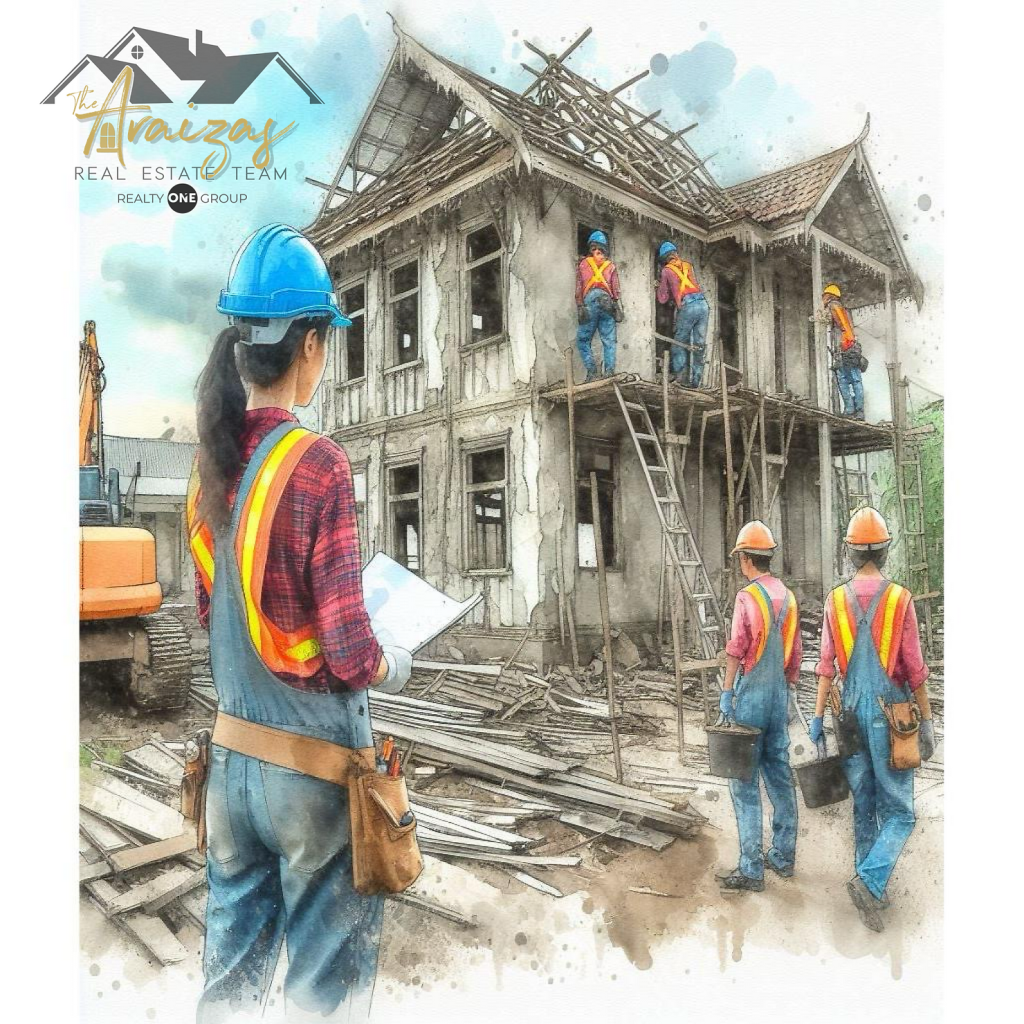

In the world of real estate, the allure of a fixer-upper is undeniable. The idea of purchasing a property at a lower price and transforming it into your dream home or a profitable investment can be incredibly enticing. However, like any major decision, buying a fixer-upper comes with its own set of pros and cons. In this blog, we’ll explore both sides of the coin to help you determine if taking on a fixer-upper is the right choice for you. Hiring the right Phoenix real estate agents can go a long way in finding the perfect property.

### Pros:

1. Lower Purchase Price: One of the most significant advantages of buying a fixer-upper is the potential for a lower purchase price compared to move-in ready homes in the same area. This initial cost savings can provide more flexibility in your budget for renovations and upgrades.

2. Customization and Personalization: Purchasing a fixer-upper allows you to put your personal stamp on your home. From layout changes to design elements, you have the freedom to tailor the property to your specific tastes and needs.

3. Potential for Increased Value: By investing in renovations and upgrades, you have the opportunity to increase the value of the property. If done strategically, you could potentially turn a fixer-upper into a profitable investment, whether through resale or rental income.

4. Opportunity for Sweat Equity: Tackling renovation projects yourself or hiring professionals to do the work can result in significant sweat equity. This means that the value of your home increases as a result of your hard work and investment, potentially leading to a higher return on investment in the future.

5. Learning Experience: Taking on a fixer-upper can be a valuable learning experience, especially for first-time homebuyers or those interested in real estate investing. It provides an opportunity to gain hands-on knowledge about home improvement, construction, and property management.

### Cons:

1. Cost and Time Overruns: Renovating a fixer-upper often involves unexpected costs and delays. From structural issues to unforeseen repairs, it’s essential to budget for contingencies and be prepared for the project to take longer than initially anticipated.

2. Emotional and Physical Stress: Renovating a fixer-upper can be emotionally and physically demanding. Dealing with the stress of living in a construction zone, making countless design decisions, and managing contractors can take a toll on your well-being.

3. Potential for Hidden Problems: Older homes, in particular, may harbor hidden problems such as outdated wiring, plumbing issues, or structural damage. It’s crucial to conduct a thorough inspection and be prepared for the possibility of encountering unexpected issues during the renovation process.

4. Limited Financing Options: Securing financing for a fixer-upper can be more challenging than for a move-in ready home. Traditional mortgage lenders may be hesitant to finance properties in need of extensive repairs, so you may need to explore alternative financing options such as renovation loans or cash-out refinancing.

5. Time and Commitment Required: Renovating a fixer-upper requires a significant time commitment, especially if you plan to do much of the work yourself. It’s essential to consider whether you have the time, skills, and resources necessary to see the project through to completion.

In conclusion, buying a fixer-upper can be a rewarding endeavor for those willing to put in the time, effort, and resources required to transform a property into their ideal home or investment. However, it’s essential to weigh the pros and cons carefully and consider your individual circumstances and goals before taking the plunge. With thorough research, careful planning, and realistic expectations, buying a fixer-upper can be a worthwhile investment opportunity.

Are you looking for Arizona Million Dollar Homes? Call The Araizas.

Leave a comment